【宏觀專業報告】聯準會 1 月 FOMC 追蹤

發布日期: 2022-01-27

原文連結: https://jackalopelin.com/宏觀專業報告/【宏觀數據追蹤】聯準會1月fomc追蹤/

【宏觀專業報告】聯準會 1 月 FOMC 追蹤

台北時間週四 (1 月 26 日) 凌晨 3 點,聯準會公開市場委員會 (FOMC) 公佈 1 月份利率決議,維持近零利率和縮減購債規模 (Taper) 不變,同時強烈暗示 Taper 將在 3 月初結束,到時很快將上調聯邦基金利率,基本符合市場所有預期。

本次會議的確有點鷹派,但更多想表達的是,讓市場有心理準備 3 月升息,其他方面似乎都還有調整空間。

談話重點 1:經濟動能已恢復 3 月升息沒問題

跟前一次 FOMC 會議比較,本次聯準會 1 月會議後發佈的政策聲明,明顯鷹派許多,但也符合市場預期,畢竟日前股市的下修,就是在反應聯準會的鷹派色彩,這次談話中,過去連喊了近兩年的支持經濟承諾,也刪得一字不剩。

最新聲明中刪除了 12 月聲明中的第一句話,即「聯準會致力於在這個充滿挑戰的時期使用全部工具來支持美國經濟」(The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.),正式代表目前經濟已經不需要聯準會在做任何刺激。

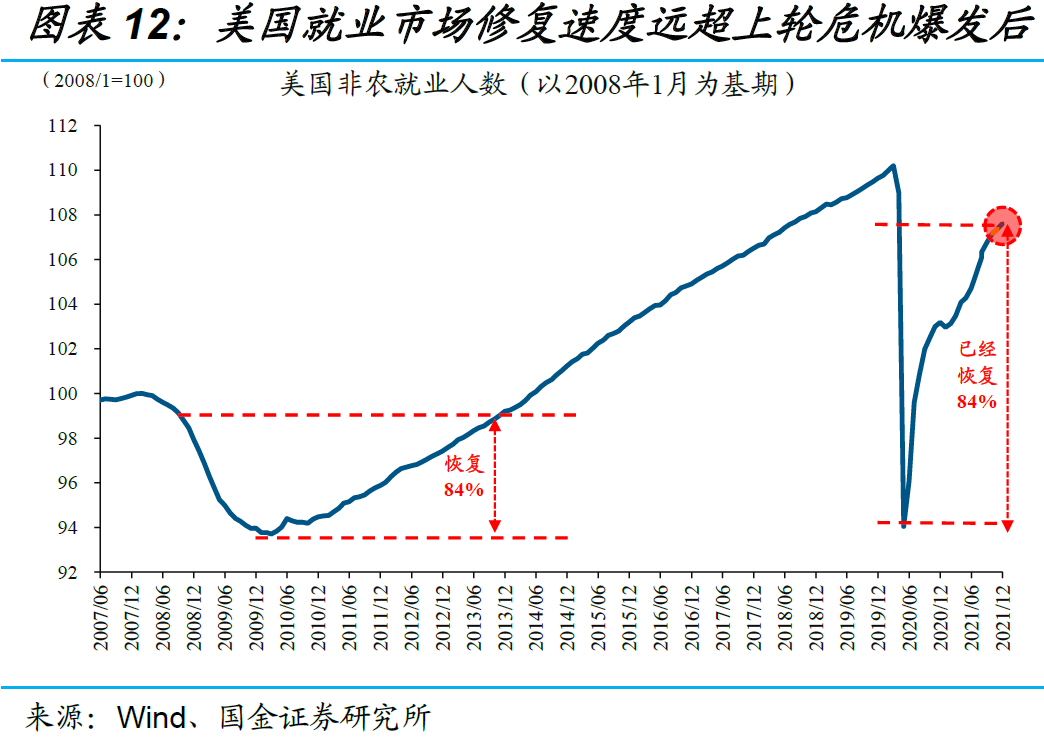

FOMC 預測,美國的經濟活動和就業指標將繼續增強。雖然 Omicron 病毒確診大幅上升,一定會對 Q1 經濟增長帶來壓力,同時許多服務業也受到衝擊,許多民眾因為確診、隔離無法上班,也可能更廣泛的影響經濟活動,所幸 Omicron 毒性不如過去的病毒株,預計病例將快速下降,同時對於經濟的影響應該也會是如此,有理由相信隨著時間推移,勞動參與以及就業會進一步改善。

至於升息時程,鮑爾提到一句 Won’t Rule Out Hike Every Meeting,這句話如果照字面上翻譯,意思是不排除每次 FOMC 會議都升息,聽起來很恐怖,但我更相信他的意思是,未來每次會議仍然會適時調整,來決定升息的時程。

談話重點 2:購債步伐不變 3 月初結束

FOMC 在聲明中稱,委員會決定繼續降低每月的資產購買規模,讓資產購買行動在 3 月初結束。從 2 月份開始,委員會將每月至少增持 200 億美元的美國國債,和 100 億美元的抵押貸款支持證券 (MBS) ,而上次會後稱,1 月起至少每月增持 400 億美元國債和至少 200 億美元機構 MBS。

聲明提到,聯準會的持續購買,將促進市場平穩運行和寬松的金融條件,從而支持信貸流向家庭和企業。長期來看,聯準會因為持有美國國債及大量資產,對美國的信貸產生了一定程度的支持,美國信貸規模不高,沒有企業大量違約的問題。

談話重點 3:升息後自然就會縮表 這是可預期的 但會隨時做調整

鮑爾表示,這次會議為縮表決策制定了指引。縮減資產負債表將發生在加息開始之後,還沒有就縮表的時機和速度做出決定,但未來每升息一次就會針對縮表議題來做討論,縮表是可預期的,今年下半年發生可能性也很高,這件事情也已經反映在市場預期上,只要美債殖利率上升速度可控,基本只是符合市場的預期。

目前聯準會的資產規模,約為 8.68 兆美元,目前預估在下半年左右會進行縮表,市場預估在第三到第四季,預估今年資產規模會將至 8.5 兆美元,在 2023 年後則是加速縮表,年底降至 7.6 兆美元,當然還是遠遠高於疫情前的水平。

談話重點 4:通膨很嚴重 但今年會明顯滑落

其實大家都很清楚,目前聯準會升息的最大原因,與其說是通膨,更可以說是就業狀態太好,讓聯準會沒有不升息的理由,事實上,聯準會升息能否抑制通膨,已經成為市場最大問號,畢竟,目前通膨仍由供應鏈瓶頸所致,市場消費動能已經有明顯滑落跡象,聯準會並沒有能力解決供應鏈的問題,所以升息對通膨似乎沒有太大幫助,真正問題還是疫情,只有疫情紓緩解封,供應鏈才能順暢。

看法:

這一次 FOMC 會議,聯準會釋出了符合市場預期的鷹派言論,昨晚美股的大漲,應該是原本預期過去幾週美股的大跌,可以情緒勒索聯準會放緩緊縮態度,不過事後看,看起來是沒得逞,美股漲幅再度收斂,但聯準會短期的利空也算是結束,至少可以讓市場專注基本面的表現。

由於 Omicron 的影響,加上美股景氣在第一季屬於下行週期,第一季應該仍會是美股疲弱的一季,我的科技股倉位已經正式落入中期修正,我不會放過中長期建倉的機會,週期投資就是這樣,我們根據週期變化來控制投入的倉位,所以宏觀數據背後的追蹤,只是讓我們理解我們在週期的哪個點上。

聯準會 FOMC 聲明變化一覽:

以下附上本次聯準會 Federal Reserve issues FOMC statement

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Patrick Harker voted as an alternate member at this meeting.

分類:【宏觀專業報告】 此文章固定連結為:請點我